Financial Education Can Be Fun For Everyone

Wiki Article

Examine This Report on Financial Education

Table of ContentsExamine This Report about Financial EducationAbout Financial EducationThe Single Strategy To Use For Financial EducationThe Best Strategy To Use For Financial Education7 Easy Facts About Financial Education DescribedHow Financial Education can Save You Time, Stress, and Money.Financial Education - Truths

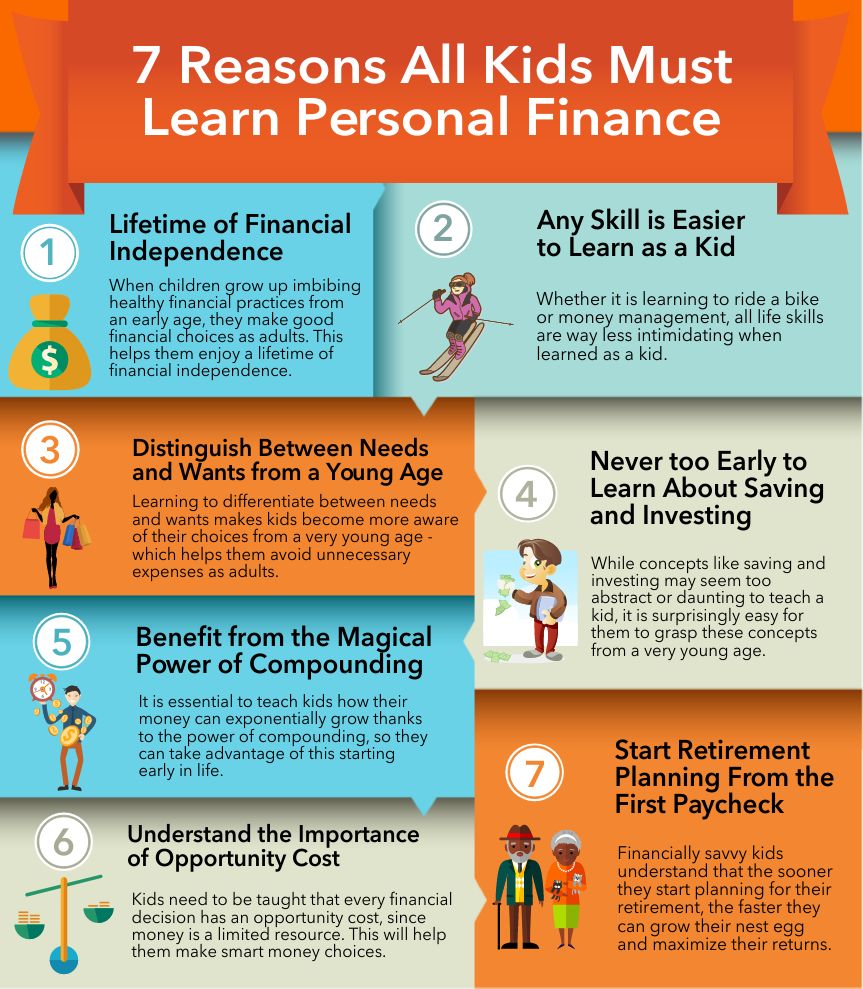

Most believe that an individual's economic trip begins when they begin with adulthood, but it begins in youth. Children these days have very easy accessibility to virtually any kind of sources, whether it is money or some property that money can purchase. Best Nursing Paper Writing Service.Asking your moms and dads for expensive gifts like an i, Phone, Mac, Publication, or Apple Watch, as well as after that tossing outbursts over it demonstrates how you are not ready for the world out there. Your parents will certainly attempt to describe this to you, however kids, especially teenagers, rarely recognize this. Otherwise taught the relevance of assuming critically before spending, there will certainly come a time when the next gen will encounter concerns, and also not find out how to manage funds as an adult.

Early discovering of ideas like the worth of intensifying, the distinction in between demands as well as desires, delayed satisfaction, opportunity cost and most notably duty will certainly hold the future generation in excellent stead. Best Nursing Paper Writing Service. Values of properties as well as cash can not be shown overnight, for that reason beginning young is essential. In various other words, whether you like it or otherwise, monetary management slowly comes to be an important component of life, as well as the earlier one starts inculcating the practice; the earlier they will certainly grasp it, as well as the far better prepared they will certainly be.

The Basic Principles Of Financial Education

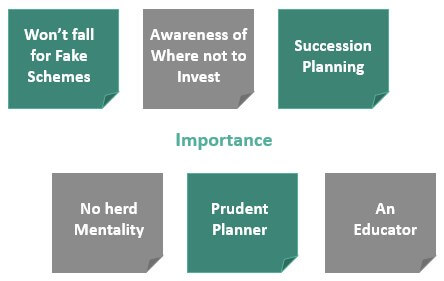

Also if it does exist, it is never necessary. The main reason is the lack of relevance provided to this topic by institutions and parents alike. If, nevertheless, it is made necessary in schools or educated by parents at residence, the advantages would be extensive: 1. Capability to make far better economic choices 2.

The Basic Principles Of Financial Education

Parents always believe regarding making sure to maintain sufficient money for their youngsters, nonetheless, they fall short to comprehend that one even more step has to be included in their future preparation for their children. They have to inculcate the basics of money in young ones before they head out into the globe independently since doing so will make them much more accountable as well as make their life much more hassle-free! Sights revealed over are the author's own.And you regularly pay interest to your general portfolio revenues, cost savings as well as investments. You additionally comprehend what you do not understand, and you request for aid when you need it. To be Bonuses monetarily literate methods having the capacity to not let money or the lack of it obstruct of your happiness as you strive and construct an American desire complete with a long and also fulfilling retirement.

Personal financing professionals advise putting in the time to learn the fundamentals, from just how to take care of a monitoring or debit account to how to pay your bills on time and also build from there. Managing your cash demands continuous focus to your costs and also to your accounts official statement and not living beyond your economic means.

The Main Principles Of Financial Education

You will certainly miss out on passion produced by a savings account. With money in an account, you can begin costs.You require to see specifically how you're spending your cash and also identify where your monetary holes are. 1. Beginning tracking your monthly expenditures In a notebook or a mobile application, compose in whenever you invest cash. Be thorough concerning this, due to the fact that it's very easy to forget. This is the structure for your spending plan.

As well as which ones can you really do without? Be straightforward, and start cutting. This is the start of the tough decisions.

Rumored Buzz on Financial Education

Consider financial savings A key component of budgeting is that you need to constantly pay on your own first. That is, you need to take a portion of every income as well as put it right into financial savings. This set technique, if you can make it a habit, will pay dividends (literally in most cases) throughout your life.Currently establish your spending plan Beginning making the necessary cuts in your taken care of and also variable expenditures. Decide what you desire to conserve every week or every two weeks. The leftover money is just how much you have to live on. Reliable budgeting needs that you are truthful with yourself and also put with each other a plan that you can actually follow.

Debit cards have benefits like no limitation on the quantity of deals and benefits based on frequent use. You have the capacity to invest without carrying cash and the cash is immediately taken out from your account. Due to the fact that using the card is so simple, it is important that you do not spend beyond your means as well as misplace how commonly you're investing with this account.

An Unbiased View of Financial Education

Some hotels, cars and truck rental firms and other businesses require that you utilize a credit scores card. You can develop your debt background and also take advantage of the time buffer between making an acquisition and also paying your expense.Counting on a charge card can cause handling serious financial debt. Need to you select see here to have a charge card, the very best method of activity is paying in full every month. It is likely you will certainly already be paying interest on your acquisitions and also the even more time you carry over a balance from month to month, the more passion you will certainly pay.

The report also said the average consumer has a credit rating card balance of $5,897. Overall Financial Obligation for American Customers = $11. 74 trillion Financial expert Chip Stapleton uses a sensible method to obtain and avoid of debt that any person can practice. A credit history can be a solid indication of your monetary well-being.

Some Ideas on Financial Education You Should Know

You can acquire a duplicate of your credit report free of charge once each year from each of the credit bureaus. Constructing a high credit history can assist you obtain approval for low-interest loans, debt cards, home mortgages, and also cars and truck settlements. When you are aiming to move into an apartment or condo or get a new job, your credit rating might be a deciding variable.Report this wiki page